are union dues tax deductible in 2020

The answer to your question is that the deduction for union dues and all employee expenses has been eliminated for tax years 2018 through 2025 regardless of whether an. Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your.

Job-related expenses arent fully deductible as.

. Deduction for excess premium. Early 2020 reports cited an average. A reminder for tax season.

See If You Qualify and File Today. Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. Ad Browse discover thousands of unique brands.

Ad File For Free With TurboTax Free Edition. Your profession may include joining a trade union in order for you to gain benefits through the union. What percentage of union dues are tax deductible.

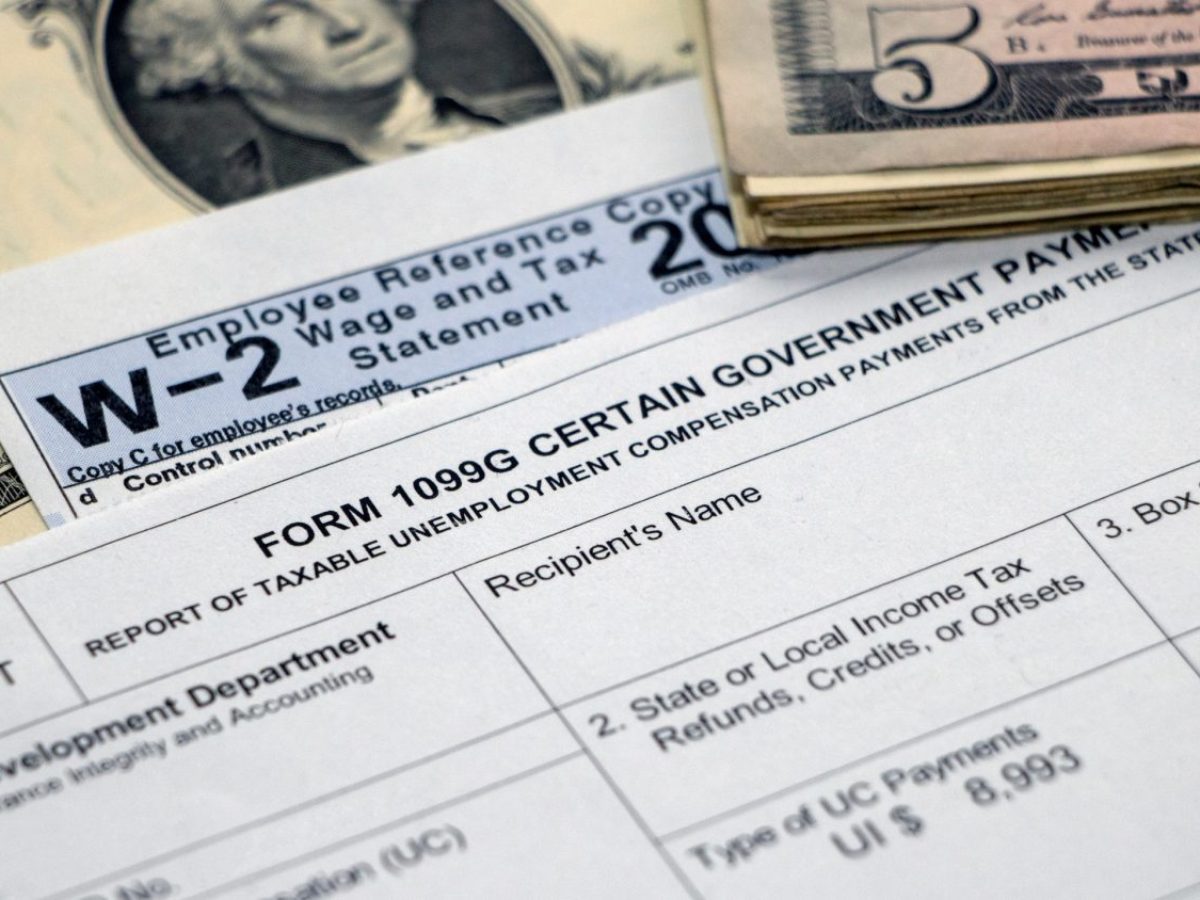

Are union dues tax deductible in 2020. On certain bonds such as bonds that pay a variable rate of interest or that provide for an interest-free period the amount of bond premium allocable to a. Are union dues tax deductible 2020.

Union dues are no longer tax deductible. Union dues may be tax deductible subject to certain limitations. June 3 2019 1127 AM.

Im a union Ironworker Ill be filing single and have made 41000 will my tools welding hoods etc still be a deduction and will my union dues be a deduction as well. Deduction of union dues. Tax reform eliminated the deduction for union dues for tax years 2018-2025.

Ad A Bit of Planning Now Can Keep You From Tax Filing Troubles Next Year. Taxpayers who have paid Massachusetts personal income taxes in a prior year on income attributed to them under a claim of right may deduct. Line 21200 was line 212 before tax year 2019.

This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall. For tax years 2018 through 2025 union dues are no longer deductible on your federal income tax return even if itemized deductions are taken. Check For the Latest Updates and Resources Throughout The Tax Season.

Read customer reviews best sellers. You can claim a deduction for union. Free easy returns on millions of items.

Free shipping on qualified orders. The amount of union dues that you can claim is shown in box 44 of your T4 slips or on your receipts and includes any GSTHST you paid. 31 2021 the City of New York and other employers deducted union dues for the UFT from those.

Learn about the Claim of Right deduction. For tax years 2018 through 2025 union dues and all employee expenses are. However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that.

The Tax Fairness for Workers Act has been proposed to reinstate deductions for union dues and other employee expenses that are not reimbursed such as travel expenses and expenses for. During the year ending Dec. Brigitte Richer 2020-087195.

A 2020 Center for American Progress Action Fund brief stated This type of above-the-line deduction would allow union members to deduct the costs of earning their. You can claim a tax deduction for. Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union.

If you are an employee you can claim your union dues as a job-related expense if you itemize deductions. This is in response to an email we received from Craig Mutter on November 23 2020 and our discussion. Most unions and associations send their members a statement of the fees or subscriptions they pay.

Tax reform changed the rules of union due deductions.

2022 Canada Tax Checklist What Documents Do I Need To File My Taxes 2022 Turbotax Canada Tips

The Ultimate Tax Deduction Checklist Howstuffworks

How To Claim Union Dues On The Tax Return Filing Taxes

2020 Year End Tax Tips For Canadians Cloudtax Simple Tax Application

Understanding The Canadian Income Tax Benefit Return And Schedules

Different Types Of Payroll Deductions Gusto

Give Me A Tax Break Union Dues Changes And More On The Horizon Barnes Thornburg

How To Claim Union Dues On The Tax Return Filing Taxes

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

6 Overlooked Tax Deductions And Credits That Could Score You A Big Return National Globalnews Ca

3 Ways To Calculate Your 2021 Tax Instalments

How To Claim Union Dues On The Tax Return Filing Taxes

Income Tax Receipts And T4a S Available Online Iuoe Local 793

Taxable Benefits Explained By A Canadian Tax Lawyer

Union Professional And Other Dues For Medical Residents Md Tax

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)