seattle payroll tax calculator

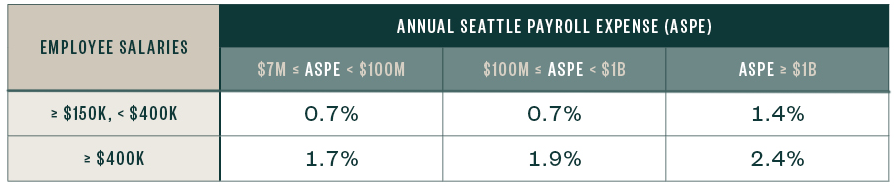

The 2021 payroll tax rates range from 07 to 24 and are subject to change annually. Washington Salary Paycheck Calculator.

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

Ad Process Payroll Faster Easier With ADP Payroll.

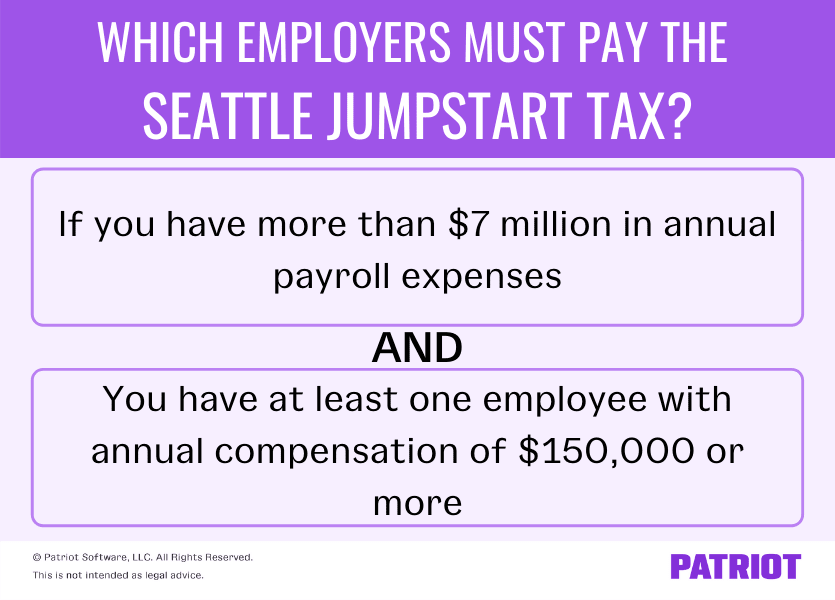

. Employers must calculate the Seattle payroll for all employees including those earning less than 150000. For starters heres a quick rundown on federal payroll taxes. Office of Labor Standards reopens reception area to public beginning Wednesday March 16th thru Friday March 18th from 900 AM - 400 PM.

2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion To contact the Seattle Department of Revenue please. If you contribute more money to accounts. Discover ADP For Payroll Benefits Time Talent HR More.

Seattles Payroll Expense Tax will begin on January 1 2021 and continuing to December 31 2040 applying rates ranging from 07 of payroll expenses up to 24 for companies with the. Subtract any deductions and. Ad Confidently Pay Employees and Never Worry About Tax Compliance Again.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and. To use our Washington Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Discover ADP For Payroll Benefits Time Talent HR More. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Washington. After a few seconds you will be provided with a full.

Ad Find Top 10 Payroll Program for 2022. Ad Confidently Pay Employees and Never Worry About Tax Compliance Again. Free Unbiased Reviews Top Picks.

Washington is one of several states without a personal income tax but that doesnt mean that the Evergreen State is a tax haven. The Seattle payroll tax is measured by the payroll expense of the business times a rate that varies based on the businesss total. Use the paycheck calculator to figure out how much to put.

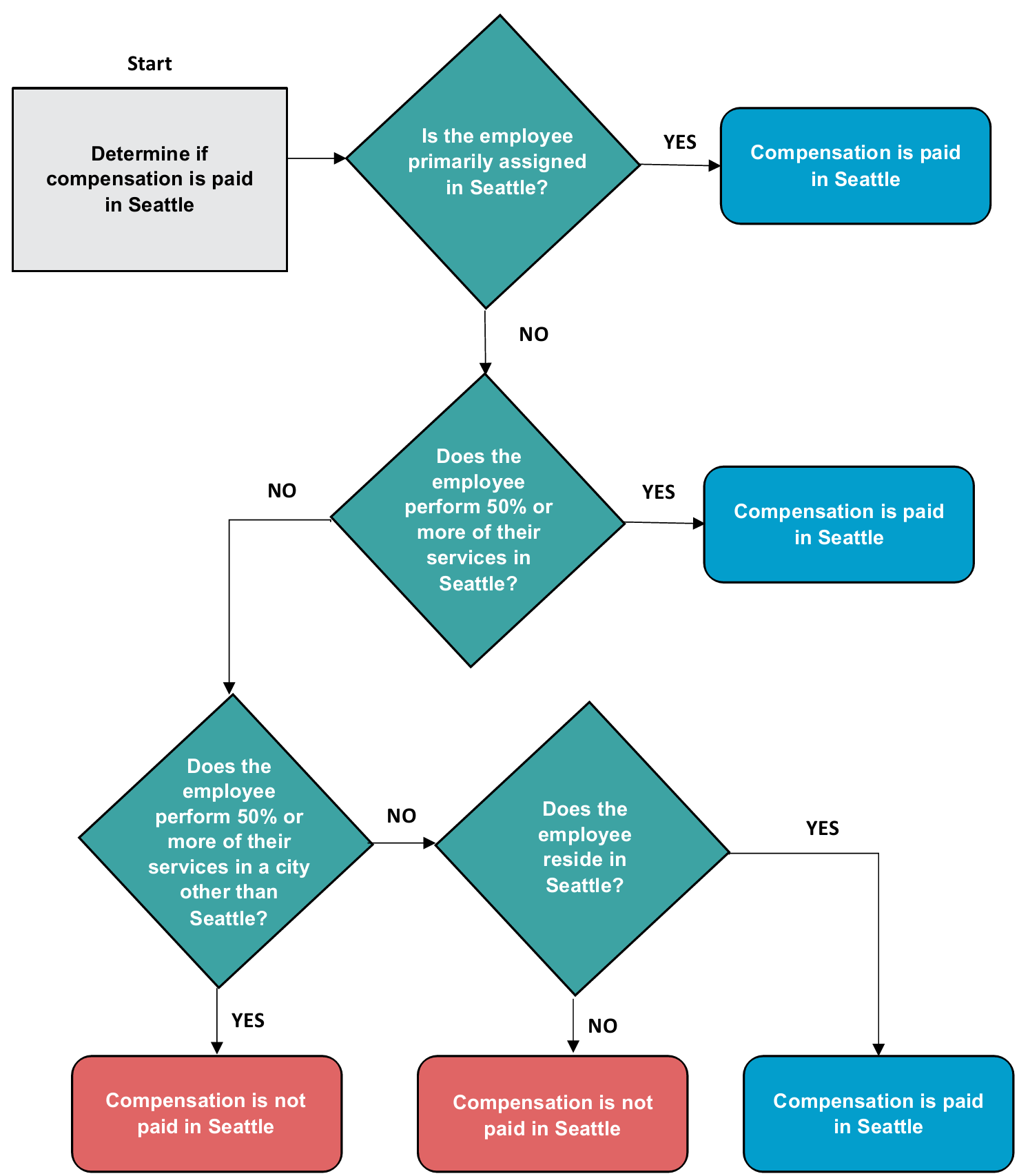

Before you can start the journey of calculating payroll taxes. See Washington tax rates. How Is the Seattle Payroll Tax Computed.

Another thing you can do is put more of your salary in accounts like a 401k HSA or FSA. Ad Process Payroll Faster Easier With ADP Payroll. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Washington Hourly Paycheck Calculator. This number is the gross pay per pay period. Get Started With ADP.

Get Started With ADP. Page down or click here for more details. While taxpayers in Washington dodge income.

Rate 07 of total annual payroll expense for employees who have annual compensation of 150 000 to 399 999. Find 10 Best Payroll Program 2022. Calculate your Washington net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

Affordable Easy-to-Use Try Now. Well do the math for youall you need to do is. The highest tax only applies to companies with 1 billion or more in payroll and only.

99 in the current year Rate 19 of total annual payroll expense for. How to File a Tax Return Employers can file a tax return online.

Washington Paycheck Calculator Smartasset

Seattle Payroll Expense Excise Tax Details

Seattle S Payroll Expense Tax Upheld By Trial Court Time For Employers To Gear Up For Reporting Insights Davis Wright Tremaine

Guest Commentary Author At The Lens

Business License Tax Seattle Business And Occupation Tax B O Tax Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll

Seattle Approves New Payroll Expense Tax Grant Thornton

Seattle Payroll Expense Excise Tax Details

What Is The Tax Rate In Seattle Usa Quora

How Much Is A 160 000 Year Salary After Taxes In California Quora

New Seattle Jumpstart Tax Overview Rates More

How Seattle S New Payroll Tax On Amazon And Other Big Businesses Will Work Geekwire

Washington Paycheck Calculator Smartasset

Gusto Help Center Washington Registration And Tax Info

Here S How Much Money You Take Home From A 75 000 Salary

New Tax Law Take Home Pay Calculator For 75 000 Salary

Government Accounting Salary In Seattle Wa Comparably

Seattle S Payroll Expense Tax Upheld By Trial Court Time For Employers To Gear Up For Reporting Insights Davis Wright Tremaine

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin